high iv stocks meaning

Thu Apr 21st 2022. Real risk free money.

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

Implied volatility is basically an estimated price move of a stock over the next 12 months.

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

. Put simply IVP tells you the percentage of time that the IV in the past has been lower than current IV. IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. The lower the IV is the less we can expect.

It is a percentile number so it varies between 0 and 100. Naturally we are coming into earnings season here so theres a reason that some of these have high IV here eg NFLX announces in a week and a half. Unfortunately this implied volatility crush catches many options trading beginners off guard.

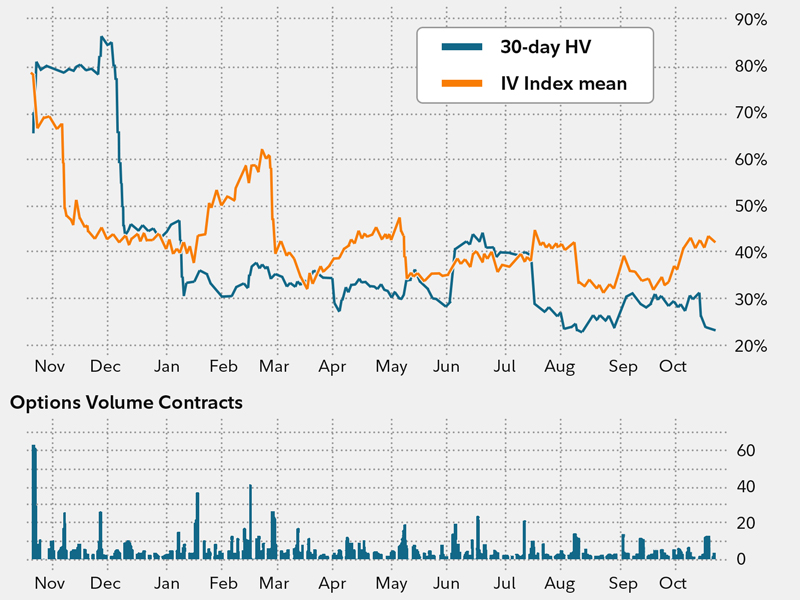

A high IV tells us that the market is expecting large movements from the current stock price over the next 12 months When equity prices decline over time Its called a bearish market which is riskier for long-term bullish investors. Traders should compare high options volume to the stocks average daily volume for clues to its origin. What is a high IV.

An IV of 20 means that there is a 68 chance 1 SD this 100 stock will move 20 on either side in a year which is. IV is useful because it offers traders a general range of prices that a security is anticipated to swing between and helps indicate good entry and exit points. 70 would mean that over the past year 252 trading days the current value is higher than 70 of the observations.

IV is the short term sentiment about the given stock that drives the option prices. Implied volatility IV is a metric used to forecast what the market thinks about the future price movements of an options underlying stock. As a result higher IV stocks are perceived to be much.

If a stock is 100 with an IV of 50 we can expect to see the stock price move between 50-150. To option traders implied volatility is more important than historical volatility because IV factors in all market expectations. If the implied volatility is high the market thinks the stock has potential for large price swings in either direction just as low IV implies the stock will not move as much by option expiration.

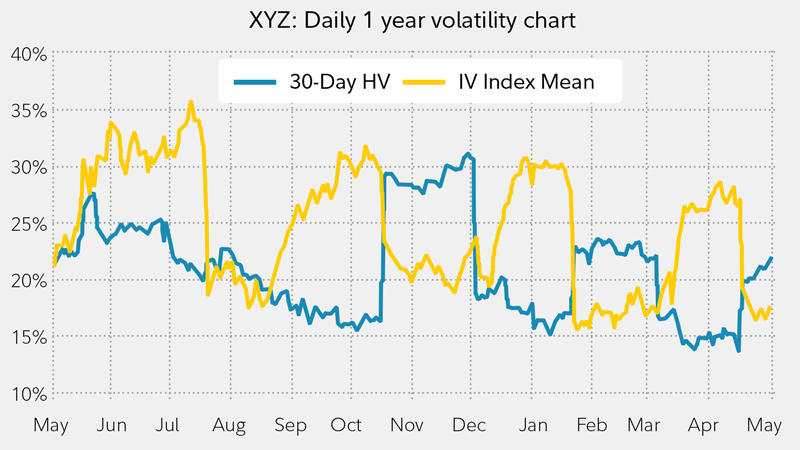

IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year. Highest Implied Volatility Options. Clearly stocks that have higher IV higher option prices relative to the stock price and time to expiration are expected to have much more significant price swings and vice versa.

High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year. How much does IV drop after earnings. Implied volatility is a measurement of how much a security will move up or down in a specific time period.

The IV drop depends mainly on the earnings results. So just because a stock might have an implied volatility of 15 doesnt mean that it is low -- if the historical benchmarks we mentioned. If IV Rank is 100 this means the IV is at its highest level over the past 1-year.

Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move. Theyre getting commissions from trades or spreads. Posted on May 1 2020 by Ali Canada - Options Trading Stock Market Training.

If the IV30 Rank is above 70 that would be considered elevated. A high IVP number typically above 80 says that IV is high and a low IVP. With stock options this period will be the life of the contract ie until the options contract expires.

Ordinarily I like IV to be 50 and IVR current IVs level relative to where its been for the past 52 weeks to be high too but I may not find a great deal of. By its nature as a predictive measure implied volatility is theoretical. Highlights heightened IV strikes which may be covered call cash secured put or spread candidates to take advantage of inflated option premiums.

By understanding both IV and IV rank you can determine the true nature of a stocks volatility. Talking about an option for a stock with a price per share at 100 indicates that the market expects -50 price movements per share. High IV means high volatility.

Typically we color-code these numbers by showing them in a red color. You are also confusing win rate with profits. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

It is seen that a surge in stock price results in exponential gain in option price which is not necessarily linear in nature and is result of implied volatility of the stock. IV is the reason two stocks trading at 100 will have completely different option prices for the same strike and expiration. In this type of market implied volatility is likely to increase.

An IV of 50 means that the market expects a volatility of 50 until option expiration. IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history. You can make 300 gains per week or month then lose 3000 in one go on a bad month.

The house is the market maker and brokers. IV crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp decline following the occurrence of significant corporate events such as earnings.

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

What Is High Iv In Options And How Does It Affect Returns

F C Investment Trust Plc Share Price Fcit Ordinary 25p Fcit

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Volatility Definition Causes Significance In The Market

Pokemon Go Appraisal And Cp Meaning Explained How To Get The Highest Iv And Cp Values And Create The Most Powerful Team Eurogamer Net

What Is Volatility Definition Causes Significance In The Market

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Calendar Spread Options Strategy Fidelity

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)